Domestic RHI – Tax free income – index linked – paid over seven years

RHI for domestic buildings has applied since 9 April 2014: RHI Domestic: d-RHI. Renewable heat installations commissioned since 15 July 2009 can receive a cashback subsidy of 21 pence per kilowatt hour – for the first seven years of the equipment used.

The Domestic RHI continued until 31 March 2022 for new installations. It was then superceeded by the Boiler Upgrade Scheme grant.

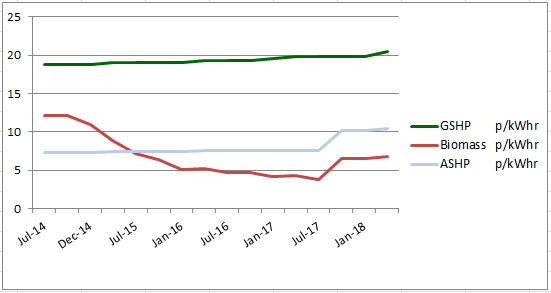

The RHI tariff table below shows the technologies that are eligible for Domestic RHI and the tariffs for each technology. The RHI provides a major incentive for owners to invest in ground source heat pumps and solar thermal renewable heat technologies. The tariffs are based on pence/kWh of deemed renewable heat delivered. The rates vary with the technology used as follows:

| RHI Domestic paid over 7 years |

p/kWh from Jan15 |

p/kWh from Apr |

p/kWh from Jul |

p/kWh from Oct |

p/kWh from Jan16 |

p/kWh from Apr16 |

p/kWh from Jul16 |

p/kWh from Jan17 |

p/kWh from Apr17 |

p/kWh from Jul17 |

p/kWh from Oct17 |

p/kWh from Apr18 |

p/kWh from Apr19 |

p/kWh from Apr20 |

| Solar thermal | 19.20 | 19.51 | 19.51 | 19.51 | 19.51 | 19.74 | 19.74 | 19.74 | 20.06 | 20.06 | 20.06 | 20.66 | 21.09 | 21.36 |

| Ground source heat pumps | 18.80 | 19.10 | 19.10 | 19.10 | 19.10 | 19.33 | 19.33 | 19.55 | 19.86 | 19.86 | 19.86 | 20.46 | 20.89 | 21.16 |

| Air source heat pumps | 7.3 | 7.42 | 7.42 | 7.42 | 7.42 | 7.51 | 7.51 | 7.51 | 7.63 | 7.63 | 10.18 | 10.49 | 10.71 | 10.85 |

| Biomass | 10.98 | 8.93 | 7.14 | 6.43 | 5.14 | 5.21 | 4.68 | 4.21 | 4.28 | 3.85 | 6.54 | 6.74 | 6.88 | 6.97 |

Tariffs increase with inflation each April, although the biomass tariff may be degressed.

To receive RHI for a domestic building, each system must be installed by an MCS certified installer.

Each domestic building must show an Energy Performance Certificate to evidence its energy use.

Deeming of heat used for Domestic RHI

Although metering of heat used is required for RHI payments for Non-Domestic buildings, for the Domestic RHI metering is seen as uneconomic and inappropriate: there is a danger that additional heat generated and wasted would increase RHI payments. Instead Ofgem pays RHI on the basis of the deemed heat used by a property, as evidenced by an Energy Performance Certificate.

However, second properties and those with fossil fuel heating alternatives will have to install meters and be paid on heat generated (up to the limit for deemed heating).

Heat Demand Limits

From 20 September 2017 new Heat Demand Limits for Domestic RHI payments were introduced for renewable heating, above which Domestic RHI will not be paid. At current rates of RHI this means:

- the limit for ASHP installations is 20,000 kWh – up to £1,348 a year for 7 years = £9,441

- the limit for biomass boilers is 25,000 kWh – up to £1,720 a year for 7 years = £12,040

- and the limit for GSHP installations is 30,000 kWh – up to £4,573 a year for 7 years = £32,011

The figures given are subject to minor adjustments depending on the peak flow temperature of the design and the details of the installation.

Shared Ground Loops

Where separate domestic properties have ground source heat pumps linked to a common ground array then it is possible to apply for Commercial RHI (at a lower rate, but over 20 years) instead of the Domestic RHI (over seven years).

However, the "heat demand limits" of 30,000 kWh that apply to domestic RHI installations from 20 September 2017 are also expected to apply to domestic properties applying for Commercial RHI using a shared ground array.

RHI Domestic – Background

Renewable Heat is a subset of the wider category of renewable energy, which includes the generation of electricity from wind turbines and photovoltaic cells.

The minister at DECC, introduced the RHI by saying: The heat used in our homes, public buildings, businesses and factories is responsible for around half of all the energy consumed in the UK, and accounts for roughly half of all UK carbon emissions. Taking action now to switch from fossil fuels to cleaner and more sustainable green sources of heat will reduce the impact that our heat requirements have on the environment and help ensure the UK has an energy supply that is safe, secure and reliable.

It is for this reason that we are introducing the Renewable Heat Incentive, making renewable heat not just an environmentally sound decision, but also a financially attractive one. This support can help drive take-up of renewables now, stimulate the renewables industry, encourage further innovation and ultimately, bring down the cost of renewable heating.

Almost half of the final energy consumed in the UK is in the form of heat. Its generation accounts for 47% of UK CO2 emissions. Renewable Heat currently satisfies only 1% of heat demand.

DECC is encouraging Renewable Heat as part of the UK's commitment to aim for the rather ambitious target of generating 15% renewables by 2020 and is introducing the Renewable Heat Incentive.

For the Renewable Heat technologies included, the energy ultimately comes from the sun. The sun provides planet earth with more energy each hour than human civilization uses over a whole year. The challenge is how to make use of this vast supply of incoming radiation to provide solar space heating and hot water.

Domestic RHI – Administration by Ofgem

The RHI is administered by Ofgem. Owners of renewable heat technologies included apply to Ofgem who will pay tariffs, on a quarterly basis, over seven years. For installations rated up to 45 kW capacity the equipment and the installers will need to be MCS certified, or equivalent.

Comment on the Renewable Heat Incentive

An investment in renewable energy usually means payment of a higher capital cost to achieve lower annual running costs (and also a lower carbon emission for the benefit for the community at large). The RHI will reduce the annual running cost of Interseasonal Heat Transfer to a very low level and allow owners to reduce the payback period from their investment to a few years.

Owners of IHT installations will benefit from the RHI for using ground source heat pumps and the RHI for using Solar Thermal when IHT is used to provide domestic hot water.

The RHI is calculated to offer a good return on initial investment

The introduction of the RHI offers a financial reward for lower carbon emissions over seven years for the renewable heating technology installed. The tariffs proposed for the Renewable Heat Incentive have been calculated to offer a rate of return of 12% on the initial investment across the tariff bands.

The introduction of the RHI coincides with a time of increasing wealth and demand for fossil fuels from an increasing world population: many pundits expect the price of oil and gas to increase much more sharply than general inflation over the next three years.

While there are a number of renewable energy options to be considered, ICAX believes the most practical and affordable answer to generating Renewable Heat is to use Interseasonal Heat Transfer.

The RHI provides a positive step change in the business case for delivering on-site renewable heat, not only to reduce energy bills and carbon emissions, but also to deliver an energy related cash flow into your building.

Tony Grayling, head of Climate Change and Sustainable Development at the Environment Agency said: Ground source heating is a rapidly growing technology that has the potential to produce at least 30% of the country’s renewable heat needs, but it needs financial support in order to grow. We would like to see this technology given adequate financial support through the new renewable heat incentive to meet its full potential in the UK.

Domestic RHI Tax free income – index linked – paid for seven years

Tariffs are exempt from income tax. This means that domestic users and other income tax payers are not taxed on any income received from the Feed-In Tariffs or the Renewable Heat Incentive.

RHI payments are also index linked – they are adjusted for inflation on 1 April each year.

For those using IHT, the annual clean energy cashback for heating will normally be larger than the annual running cost.

Can you claim for both the Green Homes Grant and the domestic RHI?

Yes, you can claim for both. The cashflow advantage of the Green Homes Grant is that you can receive payment of up to £5,000 when the heat pump is installed. The advantage of the RHI is that you can receive a larger sum – but spread over seven years from the date of installation. BEIS has confirmed that Ofgem will want to deduct any sum received from the Green Homes Grant for the heat pump installation before it pays sums due for the RHI.

See also: Banking on IHT The Merton Rule Ground Source Energy Economic Renewable Energy

See also: How Ground Source Heat Pumps work

See also: Ground Source Heating